- May 7, 2021

- Posted by: IBA LLP

- Category: Articles, Direct Tax

Residential status has taken much relevance with the Corona Virus pandemic. Due to globally imposed restrictions on the movement of people many tourists and residents of another country are stuck in India. As per income tax, a foreign citizen may end up being an Indian resident & liable to pay tax for a particular year.

So, it is important to know one’s residential status. Let us explore more about this with the impact on taxability of income in detail.

As you know there are three streams of Income: Income from Indian Sources, Income from Indian business/profession earned outside in India & Income from foreign sources.

What is residential status?

Residential Status is based on the number of days an individual resides in India. As stated by the Income Tax Act, any individual whether citizen or not, stays in India for more than specified mentioned days, then such individual shall be considered as Resident in India and pay taxes to Indian Government on the taxable income.

Let us understand this with the three types of Residential status-

- Resident Ordinary Resident (ROR)

- Resident Non- Ordinary Resident (RNOR)

- Non- Resident (NRI)

How to determine Residential status of an Individual?

For Resident:

Resident in India means an individual must pay taxes on the income earned from all the three sources. In fact, incomes which are in no relation in India on its accrual and receipt will be taxable in India. So, here are two conditions and if you satisfy any one of them, you will be Resident in India for that particular year. An individual will be resident if:

- Stays in India for 182 days or more in a year or;

- Stays in India for 60 days or more in a year and 365 days or more during preceding 4 years

Exception to condition (ii):

In the following cases, the condition of 60 days specified in criteria (ii) shall be replaced with-

- Indian Citizen leaving India for employment or as a member of crew– 182 days.

- Indian Citizen or Person of Indian origin, visiting India, having Indian Income up to Rs. 15 Lakhs in a year- 182 days

- Indian Citizen or Person of Indian origin, visiting India, having Indian Income Exceeding Rs. 15 Lakhs- 120 days.

Such as if Ajay is an Indian Citizen who got transferred to America to work in a well reputed MNC, then only first condition of 182 days will be applied to check his residential status.

When an individual qualifies the above conditions as Resident, then we will determine if he is Resident Ordinary Resident (ROR) / Resident Non-Ordinary Resident (RNOR).

Individuals who meet any of the below conditions are RNOR-

- Classified as NRI in 9 out of 10 years

- Stays in India for less than 730 days in the last 7 years

- An Indian citizen or person of Indian origin who earns for more than Rs. 15 lakhs and visits India for more than 120 days but less than 182 days in a year & if he spent more than 365 days during preceding 4 years (Inserted by Finance Bill,2020)

The benefit is given to Non – Ordinarily Residents, as they do not have to pay tax on the income from Foreign sources.

For Non-Resident (NRI):

An individual who does not satisfy the basic conditions of resident can be considered as a non-resident. NRI pay taxes only on Income earned from Indian Sources.

Recently, the Finance Bill, 2020 inserted section 6(1A). It applies only to NRI Indian citizen, who is not a tax resident of any country and has more than Rs. 15 lakhs income in India. Any individual who falls into this category will deemed to be Resident in India.

Notes –

(1) This section will not apply to an individual who is a resident in India in the previous year.

(2) A deemed resident would always be a RNOR.

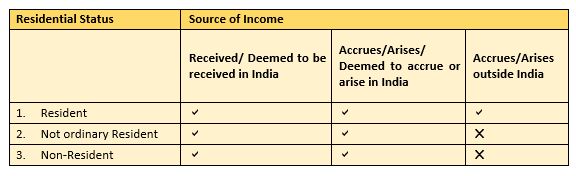

On what basis Incomes are taxable in India?

As per of The Income Tax Act, the tax on income will be liable in India if its source fall into the following category which is explained in the following table:

Conclusion:

So, it is clear from the above discussion that the impact of Finance bill, 2020 will only affect a deemed resident, person of Indian origin or an Indian citizen with more than 15 lakhs income from India. Therefore, we must take residential status into consideration to understand our tax liabilities.

Author : Vidushi Agarwal